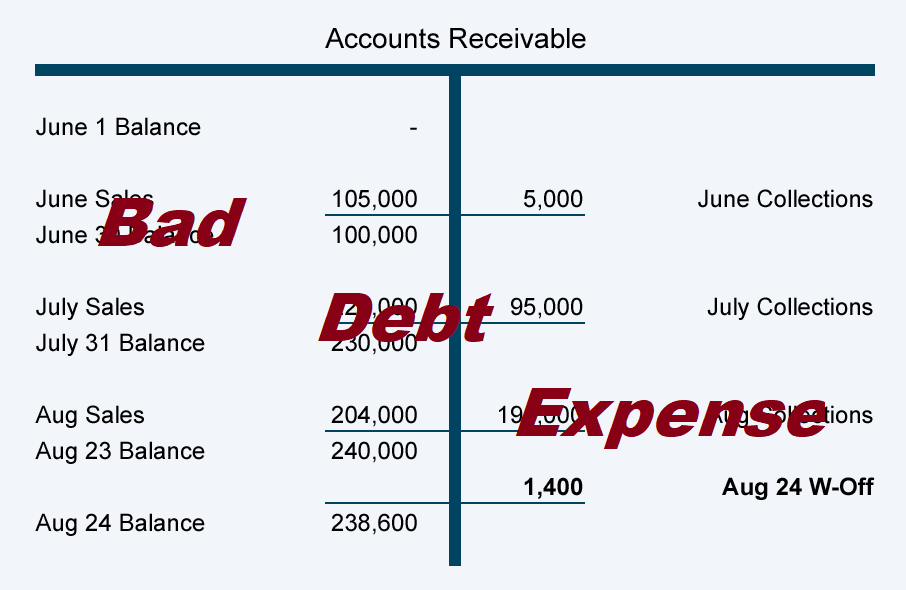

chart of accounts bad debt expense. When bad debts are recovered, the bad debts recovery account is other income in the income statement. Accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”.

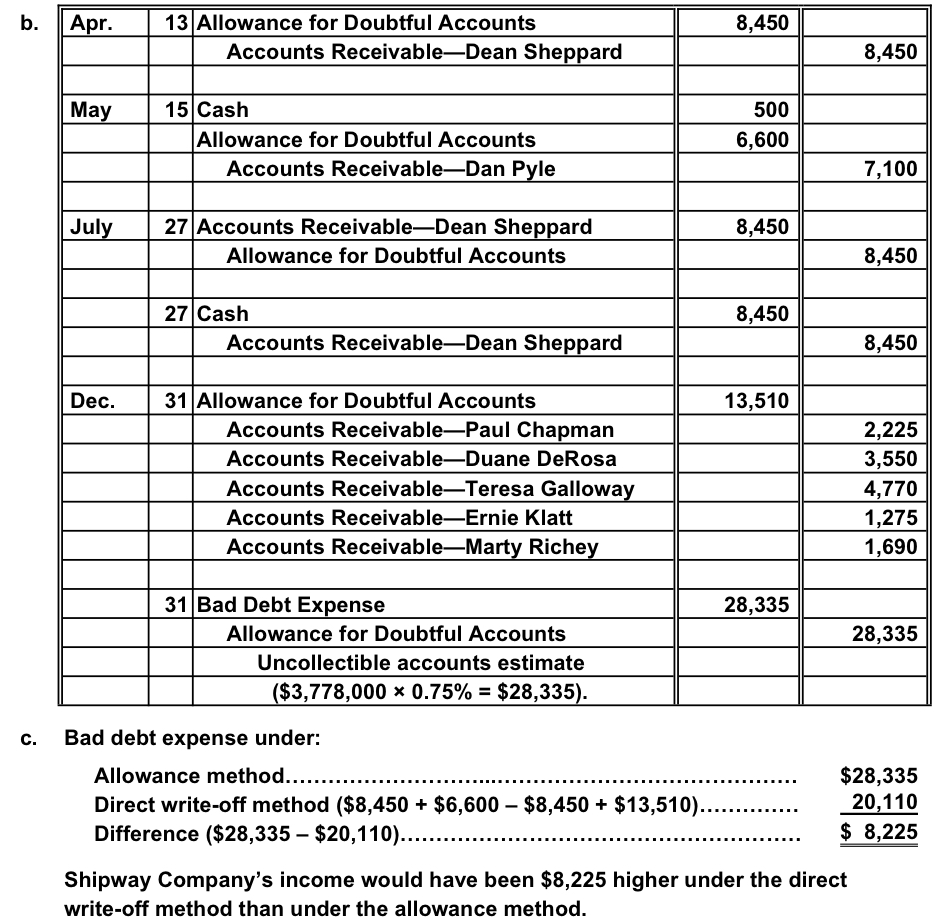

chart of accounts bad debt expense When bad debts are recovered, the bad debts recovery account is other income in the income statement. It is the amount that the company. The journal entry debits bad debt expense and credits accounts.

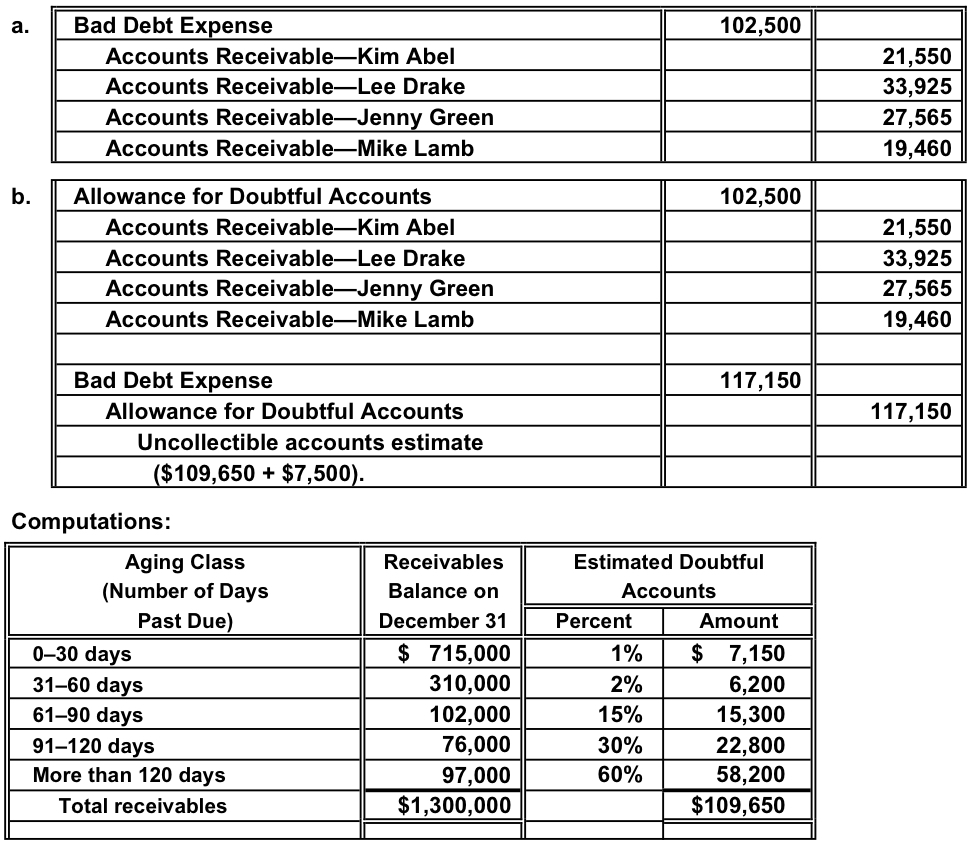

The Journal Entry Debits Bad Debt Expense And Credits Accounts.

The account receivables are credited by the amount of bad debt. It is the amount that the company. When bad debts are recovered, the bad debts recovery account is other income in the income statement.

These Guidelines Help Ensure That The.

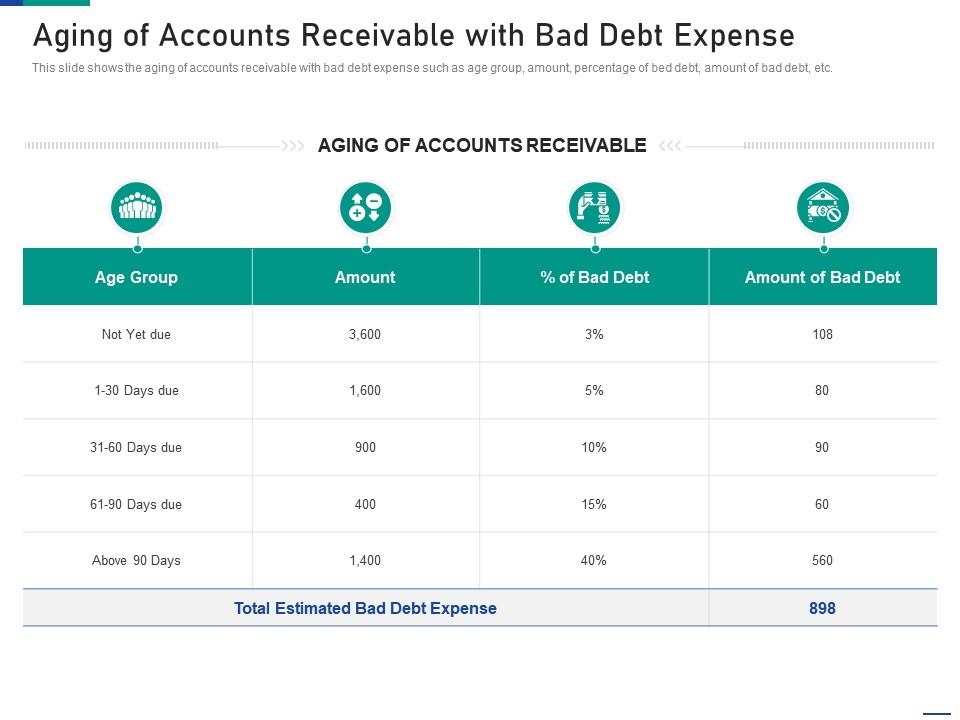

Bad debt expense is the loss that incurs from the uncollectible accounts where the customers did not pay the amount owed. Accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. Bad debts are the account receivables that have been clearly identified as uncollectible in the present or future time.

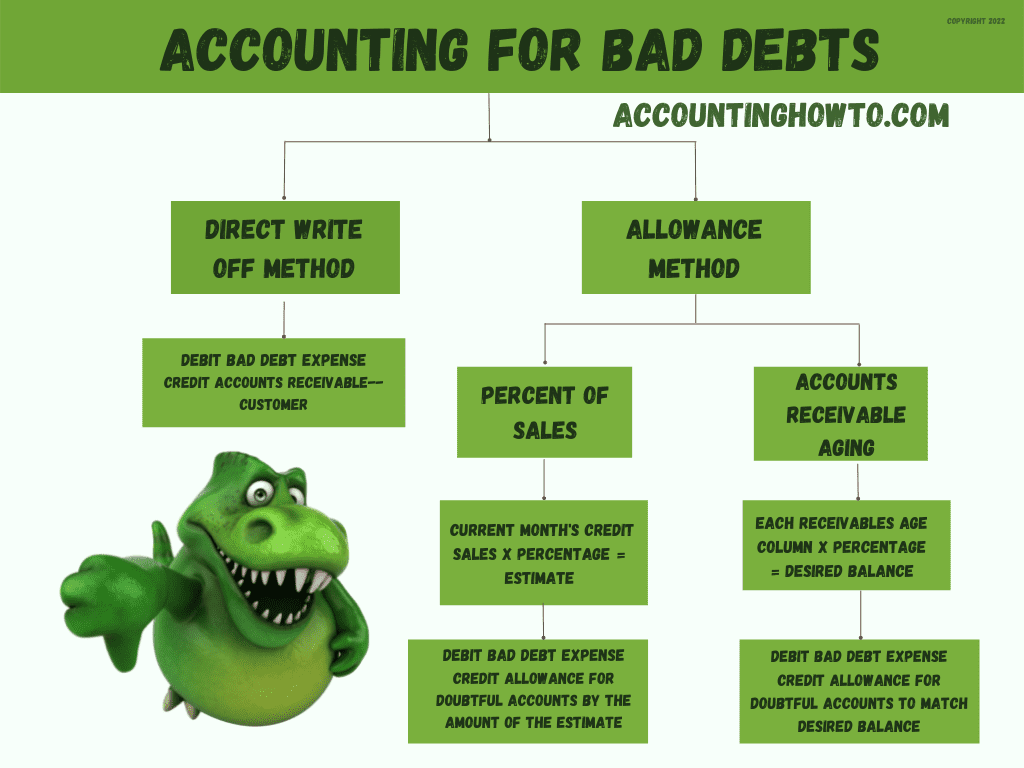

The Correct Bad Debt Expense Journal Entry Depends On Which Method You’re Using.

When you write off bad debt, you simply acknowledge that you have.